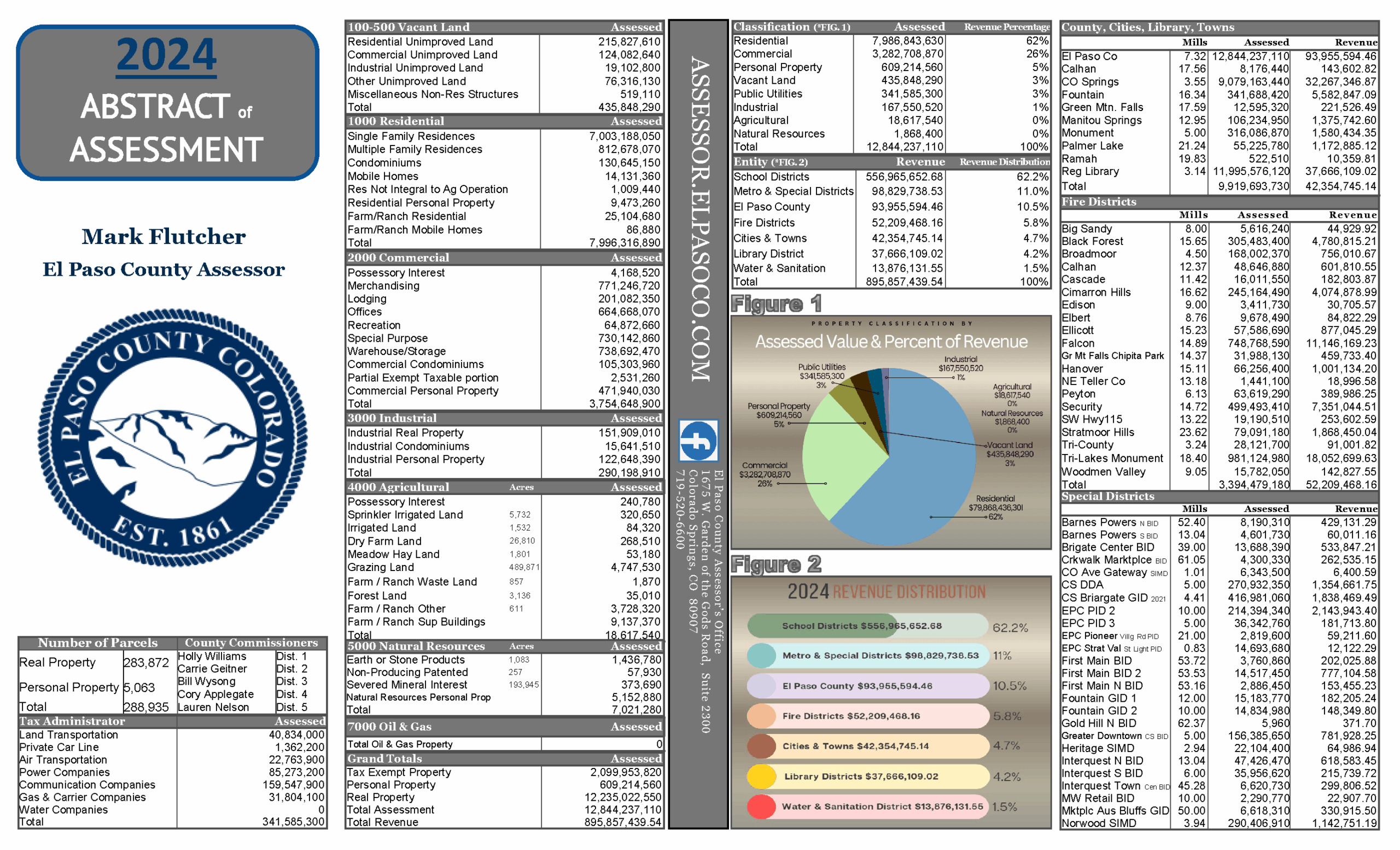

- It is the duty of the Assessor to make a fair and equitable assessment of all property in El Paso County. Taxes are distributed equally in accordance with the value of each taxpayer’s property.

- The percent of actual value of all residential and multi-family property is determined by the State Legislature.

- For 2026, the assessment rate for residential is 6.8%, commercial is 25% and vacant land is 26%

2026 Property Class & Sub-Class Assessment Rates

2025 Property Class & Sub-Class Assessment Rates